Karura Community SACCO is a Kenyan credit union that started in 2017 with 50 members from the Karura Community Chapel in Nairobi. The Savings and Credit Cooperative (SACCO) has grown to 2,800 members from over 10 countries. The SACCO’s vision is to empower people socio-economically. They offer a variety of savings and loan products to their members, and aim to double their membership base each year.

The key to these ambitions was to adopt digital infrastructure that could automate reporting, loan approvals and member registrations, freeing up time for SACCO staff to recruit and serve members. To do that, Karura SACCO turned to Kwara.

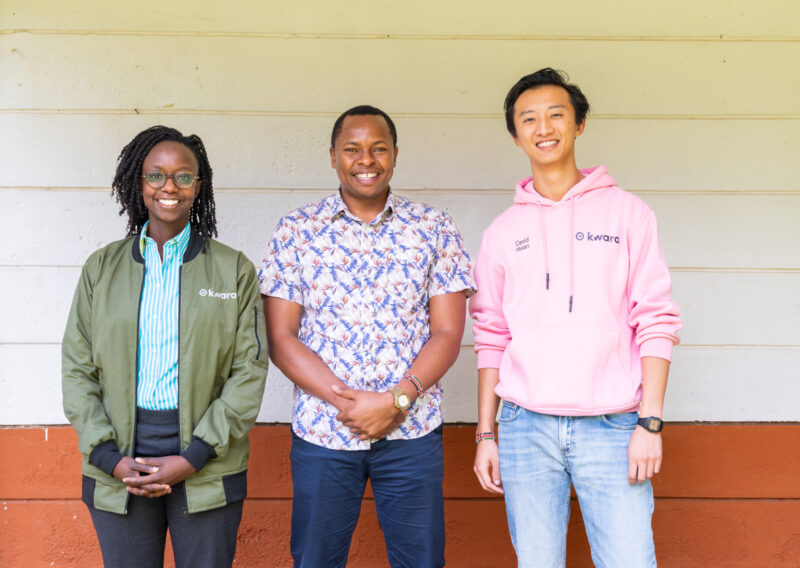

The SACCO industry in Africa was transformed when Kwara came in. SACCOs and indeed Karura SACCO can now affordably compete through digitization. What seemed impossible, Kwara has made possible.

Gitonga, CEO – KCS SACCO

Automating operations, kick-starting 2.5x member growth

Before using Kwara’s platform, Karura SACCO faced numerous challenges, including poor vendor support, lack of a mobile app, errors with reports, and poor interest calculations. These challenges had a negative impact on the SACCO’s financial situation, as members were not satisfied and did not always trust the balances.

Members’ queries took up a lot of time, which limited the SACCO’s ability to diversify products and market to members. With Kwara’s platform, Karura SACCO has been able to automate many of its operations, including member onboarding, loan processing, reporting, security and interest calculations. This has enabled the SACCO to free up staff time, increase member satisfaction, and diversify its product offerings.

I remember those days before Kwara. We used to spend a lot of time answering member queries. Now we’re spending that time thinking how we can diversify our products and market to more members.

Gitonga, CEO , KCS SACCO

Reporting and stability for regulatory approval

Karura SACCO has been able to kick-start 2.5 times growth in its membership, from 800 to 2,800 members, with the help of Kwara’s platform. One of the main drivers for this is Kwara’s mobile channels, the Kwara App and USSD code *341#, which allow members to easily access their accounts and services via their phones. Prospective members can effortlessly enroll for Karura SACCO membership by simply downloading the Kwara App, allowing them to initiate their savings journey from day one.

SASRA is an accreditation that every SACCO wants to have. During the application process you should have basic financial reports, which are all available on the Kwara system.

Gitonga, CEO , KCS SACCO

If you are SASRA regulated, members know you have systems and policies in place that can handle funds with care. According to KCS, they belong to the less than 2% of SACCOs in Kenya that reach this accreditation.

Results

- Membership grew from 800 to 2,800 in two years with Kwara

- SASRA Non-DT license obtained, SASRA accreditation achieved, and regulatory compliance improved

- Diversified products marketed to members including instant loans, group member products, term deposits with fixed time, and group savings

- Kwara core banking platform’s user-friendly and customized interface allowed easy access to reports and information

- Asset base grew from KES 40,000,000 to KES 185,000,000 AUM

- Mobile channels led to international scale in 10+ countries

Want to find more about Karura Community SACCO? Find them on the Kwara App here!